by Russell Noga | Updated June 23rd, 2023

Do you have a Medicare supplement plan? These policies partially or fully cover the out-of-pocket expenses associated with Original Medicare Parts A & B.

Do you have a Medicare supplement plan? These policies partially or fully cover the out-of-pocket expenses associated with Original Medicare Parts A & B.

The last thing your retirement planning needs is to cover a huge hospital or medical bill.

A Medigap plan provides insurance against this event. Private healthcare insurers offer Medigap plans to seniors over 65 enrolled in Medicare Parts A & B.

The best time to sign up for Medigap is in the six months after you turn 65. During this time, you will be guaranteed acceptance into the policy, even if you have pre-existing health conditions.

This article unpacks the Medigap offering from Harvard Pilgrim including their Medicare Supplement plans offered in 2024.

We’ll look at the plans available, average premium costs, plan benefits, and perks.

Compare 2025 Plans & Rates

Enter Zip Code

Harvard Pilgrim Medicare Supplement Plans at a Glance

- Harvard Pilgrim serves Maine, New Hampshire, and Massachusetts with Medigap plans.

- The company offers five pans in Maine and New Hampshire, and three plans in Massachusetts.

- Harvard Pilgrim offers excellent additional perks for its Medigap clients, including discounts on hearing, vision, and dental services.

Who Is Harvard Pilgrim?

Incorporated in 1969, Harvard Pilgrim is an insurance company selling Medicare supplement plans to Massachusetts, Maine, and New Hampshire residents. They have headquarters in Canton, Massachusetts. And a history of 54 years serving these communities.

What Medicare Supplement Plans Does Harvard Pilgrim Offer?

In Maine and New Hampshire, Harvard Pilgrim sells five different Medigap plans, A, F, G, and M; in Massachusetts, it sells three plans.

Plan A – Basic benefits for Medicare Part A, with no Medicare Part A or B deductible coverage. The plan does cover Medicare Part B coinsurance and copayments.

Plan F – The highest level of cover and benefits in the Medigap range. Plan F also covers the Medicare Part B deductible.

Plan G – Near-comprehensive coverage. The only benefit not offered is coverage for the Medicare Part B deductible.

Plan M – This plans offers basic benefits for Medicare Part A & B and 50% coverage for the Medicare Part A deductible.

Plan N – This policy comes with copayments for visiting the doctor’s office and hospital. There is no coverage of Medicare Part B deductible or excess charges.

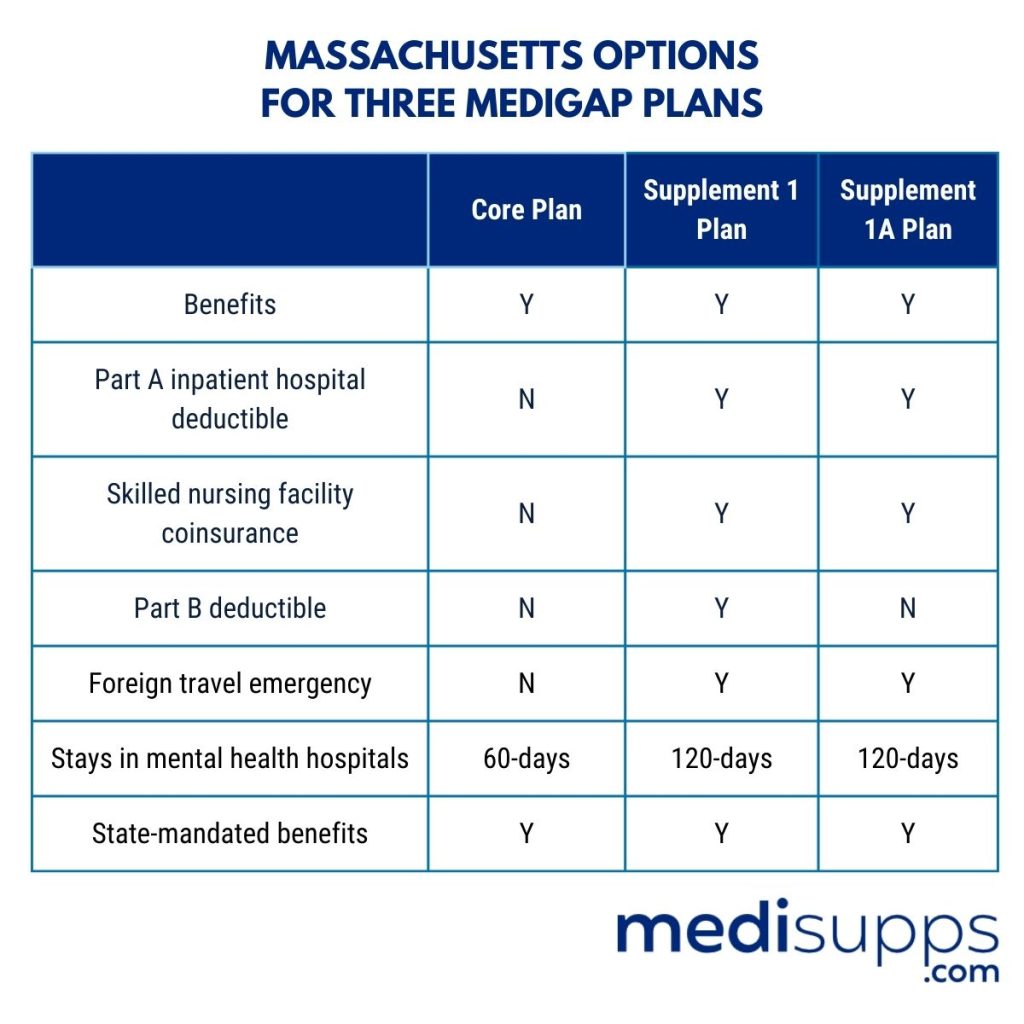

Medigap policies have different standardized benefits in Massachusetts. Wisconsin and Minnesota states have Federal waivers allowing them to operate differently. Massachusetts residents have options for three Medigap plans.

- Core Plan – The basic coverage with additional riders available.

- Supplement 1 Plan – Comprehensive coverage similar to Plan F.

- Supplement 1A Plan – Near comprehensive coverage similar to Plan G.

Harvard Pilgrim Medicare Supplement Plans – Benefits & Coverage

Medigap plans have standardized benefits for Original Medicare Parts A & B. The CMS regulates the industry, ensuring all Medigap healthcare providers meet regulatory standards for Medicare Part A & B benefits.

The Medigap benefits offered by Providence are the same as those offered by any other industry provider.

All Medigap plans offer the following benefits for Original Medicare Parts A & B.

- Part A coinsurance and hospital costs for up to 365 days after using up Medicare benefits.

- Part A hospice care coinsurance or copayment.

- Part B coinsurance or copayment.

- Blood transfusion costs for the first three pints of blood.

Plans F, G, and N offer additional Medicare Parts A & B benefits.

Plans F, G, and N offer additional Medicare Parts A & B benefits.

- Part A deductible.

- Part B excess charges (Plan N doesn’t cover these charges).

- Skilled nursing facility care coinsurance.

- 80% of emergency healthcare costs when traveling outside the US for 60 days. ($250 deductible and $50,000 maximum apply).

- Unlimited coverage for all out-of-pocket costs.

*Plan F is discontinued for seniors eligible for Medicare after January 1, 2020. If you qualify for Medicare before this date, you can request a Plan F policy from Harvard Pilgrim. However, unless you have protection from guaranteed issue rights, you’ll have to undergo medical underwriting when signing up.

The underwriting process looks at your pre-existing conditions. Depending on your risk profile, Harvard Pilgrim may charge you above-average rates for Plan F premiums, or deny your application to join its Medigap scheme.

Contact our team and we’ll help you understand guaranteed issue right and whether they apply to your situation.

What Harvard Pilgrim Medicare Supplement Plans Don't Cover

Medigap Plans cover medical and hospital benefits relating to Original Medicare Parts A & B. So, you don’t get coverage for private duty nursing services or stays at unskilled nursing homes. There’s also no coverage for prescription drugs or cosmetic procedures.

Medigap doesn’t cover expenses involved with vision, hearing, or dental services. There’s no coverage for preventative treatments with the physiotherapist, chiropractor, acupuncturist, or podiatrist. Medicare may cover these expenses if deemed medically necessary by your doctor. In this case, Medigap would cover the remaining out-of-pocket costs.

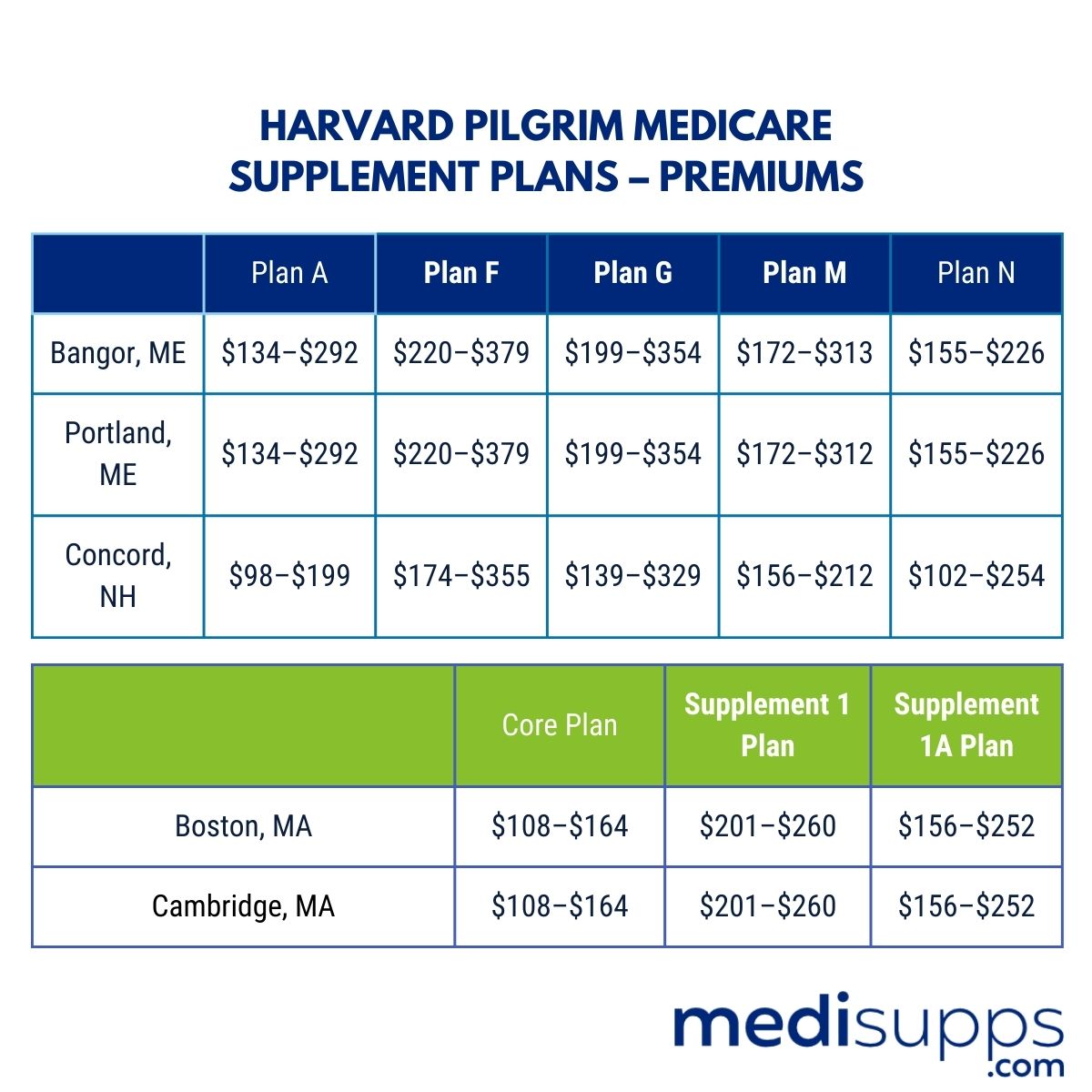

Harvard Pilgrim Medicare Supplement Plans – Premiums

Harvard Pilgrim uses your personal information to create a “risk profile” on you when assessing you for your monthly premiums. They’ll look at information on your gender, age, smoking status, and location in the United States to set your rates. Here are the average premiums a 65-year-old woman can expect to pay for Medigap plans from Harvard Pilgrim.

*Your premium rates may vary depending on your unique risk profile.

Compare Medicare Plans & Rates in Your Area

Harvard Pilgrim Medicare Supplement Plans – Additional Benefits & Discounts

Harvard Pilgrim offers its Medigap beneficiaries a discounted Universal Dental Plan, providing a 20% to 50% discount on dental procedures using its network of participating dentists. Members get discounts on hearing aids and eyewear, and savings on acupuncture sessions, massage therapy, and chiropractic care. Members also receive discounts at fitness facilities or classes.

Harvard Pilgrim Medicare Supplement Plans – Third-Party Ratings & Reviews

Harvard Pilgrim doesn’t have an AM Best rating due to its structure as a not-for-profit status and its size. Harvard Pilgrim Insurance has an A+ rating with the Better Business Bureau (BBB).

Compare 2025 Plans & Rates

Enter Zip Code

Frequently Asked Questions

What are Harvard Pilgrim Medicare Supplement Plans?

Harvard Pilgrim Medicare Supplement Plans are insurance policies offered by Harvard Pilgrim that provide additional coverage to fill the gaps left by Original Medicare.

Who is eligible for Harvard Pilgrim Medicare Supplement Plans?

Individuals who are already enrolled in Medicare Part A and Part B are eligible for Harvard Pilgrim Medicare Supplement Plans.

When can I enroll in Harvard Pilgrim Medicare Supplement Plans?

You can enroll in Harvard Pilgrim Medicare Supplement Plans during your Medigap Open Enrollment Period, which starts when you are 65 years old and enrolled in Medicare Part B. However, you may also be eligible for a Special Enrollment Period under certain circumstances, or apply for one of their Medigap plans at any time during the year if you are already enrolled in a Medigap plan, or enrolled in Medicare Part A and B only.

What is the difference between Harvard Pilgrim Medicare Plan G and Plan N?

Harvard Pilgrim Medicare Plan G and Plan N are similar in coverage but differ in cost-sharing. Plan G provides more comprehensive coverage, including coverage for Medicare Part A and Part B deductibles, while Plan N requires cost-sharing for certain services such as copayments for doctor visits and emergency room visits.

What types of coverage are included in Harvard Pilgrim Medicare Supplement plans?

Harvard Pilgrim Medicare Supplement plans cover costs such as Medicare Part A and Part B coinsurance, copayments, and deductibles, as well as coverage for excess charges.

Can I use any healthcare provider with Harvard Pilgrim Medicare Supplement plans?

Yes, you can choose any healthcare provider who accepts Medicare with Harvard Pilgrim Medicare Supplement plans.

How do I choose the right Harvard Pilgrim Medicare Supplement Plan for me?

Call us today at 1-888-891-0229 to learn more about the difference of each plan and their benefits to see which one is right for you.

Are prescription drugs covered under Harvard Pilgrim Medicare Supplement plans?

No, prescription drug coverage is not included in Harvard Pilgrim Medicare Supplement plans. You would need to enroll in a standalone Medicare Part D prescription drug plan for prescription drug coverage.

What are the benefits of having Harvard Pilgrim Medicare Supplement plans?

Benefits of Harvard Pilgrim Medicare Supplement plans include reduced out-of-pocket expenses, flexibility in choosing healthcare providers, and the peace of mind that comes with comprehensive coverage.

Call Us for More Information on Harvard Pilgrim Medicare Supplement Plans

Call our fully licensed Medigap agents at 1-888-891-0229 for a free consultation and quote on Harvard Pilgrim Medigap plans. We’ll help you choose the best Medigap plan to cover your healthcare needs and source you the best rate on monthly premiums.