by Russell Noga | Updated October 3rd, 2024

If you’re a Medicare beneficiary who lives in the great state of Texas, you may be wondering how to pay for the out-of-pocket expenses that Original Medicare doesn’t cover.

Medicare supplement insurance plans (also known as Medigap plans) are a great option, as they are specifically designed to cover the gaps in Medicare Part A and Part B coverage.

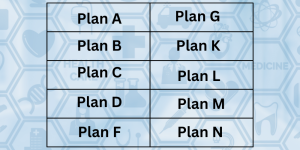

There are a total of 10 standardized Medigap plans that Medicare beneficiaries can purchase for an additional charge. Medicare Supplement Plan G is one of those plans.

What is Medigap Plan G? What does it cover? How much does this plan cost for Medicare beneficiaries who reside in Texas?

Keep on reading to find the answers to these questions and more – and to determine if Medicare Supplement Plan G is the right option for you.

What is Medigap Plan G?

Original Medicare – Medicare Part A and Part B – covers a lot of healthcare-related expenses; however, it doesn’t cover everything. As a Medicare beneficiary, you are responsible for covering the cost of coinsurance, copayments, and deductibles out of your own pocket.

Original Medicare – Medicare Part A and Part B – covers a lot of healthcare-related expenses; however, it doesn’t cover everything. As a Medicare beneficiary, you are responsible for covering the cost of coinsurance, copayments, and deductibles out of your own pocket.

As you can imagine, these out-of-pocket expenses can get pretty pricy, especially if you expect you’re going to require a lot of medical care. Medicare supplement insurance can help to pay for those expenses.

Sold by private insurance companies, Medicare supplement insurance is designed to cover medical costs that Original Medicare doesn’t cover, such as deductibles, coinsurance, and copays.

Also known as Medigap insurance, there are a total of 10 different plans available, and each type covers different costs and different rates.

Plan G is one of the most popular Medigap supplement insurance for 2025 policies among Texas residents, as it offers the most comprehensive coverage; in other words, it covers the most gaps in Medicare coverage.

Medicare Supplement Plan G Benefits in Texas

As mentioned, Plan G is one of the most popular Medigap plans among Texas Medicare beneficiaries, offering the most comprehensive coverage.

As mentioned, Plan G is one of the most popular Medigap plans among Texas Medicare beneficiaries, offering the most comprehensive coverage.

It’s a standardized plan, meaning that the benefits are the same throughout the country; for example, whether you use it in Texas, California, Florida, or New York, you will receive the same benefits.

Discover 2025 Rates

Enter Zip Code

Medicare Supplement Plan G Costs in Texas

It’s important to note that Medicare supplement insurance policies – including Plan G – are not subsidized, meaning that the insurance companies that sell these plans set the premiums.

To calculate rates for Plan G, health insurance companies in Texas use one of the following methods:

- Issued Age. Premiums are based on your age when you purchase Medigap Plan G.

- Current Age. Premiums are based on your current age.

- Community-rated. Premiums are the same as all other Medicare beneficiaries who have purchased Plan G.

Other factors may also be taken into consideration, whether or not you use tobacco products, for example.

At Compare Medicare Supplement Plans, our team of licensed agents will be happy to assist you with securing the best rates for Medicare Supplement Plan G in Texas.

How to Enroll in Medicare Supplement Plan G in Texas

In order to purchase Medigap Plan G, you must be enrolled in both Medicare Part A and Medicare Part B. The ideal time to enroll for this Medicare supplement insurance policy is during the Medicare enrollment period, which begins the first day of your birth month, the year that you turn 65.

Insurance companies cannot take your current health status or your health history into consideration during this period, so you are guaranteed issue rights during open enrollment.

For instance, if you turn 65 in April and you are enrolled in Part A and Part B, the ideal time to enroll is between the months of April and October.

While you can purchase Medigap Plan G after the enrollment period, you run the risk of paying higher premiums or not being approved at all. This is because, after the open enrollment period, insurance companies that offer Medicare Supplement Plan G insurance can consider your current health status and medical history.

If you already have Medigap insurance, you can switch plans at any time by submitting an application with your provider.

Doing so could save you money, as the rates may be lower, so weighing your options periodically is advisable.

Compare Medicare Plans & Rates in Your Area

Is Medicare Supplement Plan G the Best Medigap Option in Texas?

As discussed, there are a total of 10 standardized Medigap plans, and the specific plan that will work best for you depends on your specific needs.

With that said, however, Plan G is the most popular Medicare supplement insurance policy in the state of Texas, as it offers the most comprehensive benefits and it significantly cuts out-of-pocket expenses.

Find the Best Medigap Plan G Rates in Texas

If you think that Medicare Supplement Plan G is the right option for you’d like to start getting quotes, simply fill out the form to the right to receive a list of the best rates in Texas.

If you have questions and would like guidance and support, give us a call directly at 1-888-891-0229 and one of our licensed, knowledgeable, and friendly agents will be glad to answer all of your questions and assist you with all of your needs.

Compare 2025 Plans & Rates

Enter Zip Code

Frequently Asked Questions

What is Medicare Supplement Plan G in Texas?

Medicare Supplement Plan G in Texas is a private health insurance plan designed to supplement Original Medicare coverage. It helps cover the out-of-pocket costs that Medicare beneficiaries would otherwise have to pay, such as deductibles, copayments, and coinsurance.

What does Medicare Supplement Plan G cover in Texas?

Medicare Supplement Plan G in Texas offers comprehensive coverage. It covers Medicare Part A deductible, skilled nursing facility coinsurance, Part A and B coinsurance or copayments, Part B excess charges, and even provides coverage for medical expenses incurred while traveling abroad.

How does Medicare Supplement Plan G in Texas differ from other Medigap plans?

Medicare Supplement Plan G in Texas offers coverage similar to Medicare Supplement Plan F. The main difference is that Plan G does not cover the Part B deductible. However, it often has lower monthly premiums compared to Plan F, making it a popular choice among beneficiaries.

Can I enroll in Medicare Supplement Plan G in Texas if I am a new Medicare beneficiary?

Yes, if you are a new Medicare beneficiary in Texas, you can enroll in Medicare Supplement Plan G. Unlike Medicare Supplement Plan F, which is not available to new beneficiaries, Plan G is a viable option to consider for comprehensive coverage.

Is Medicare Supplement Plan G in Texas more affordable than Plan F?

Medicare Supplement Plan G in Texas generally has lower monthly premiums compared to Plan F. While Plan G requires beneficiaries to pay the Part B deductible out-of-pocket, the lower premiums can make it a more cost-effective option in the long run.

Can I switch from my current Medigap plan to Medicare Supplement Plan G in Texas?

Switching from one Medigap plan to another in Texas is possible, but it depends on several factors, including your health status and the insurance company’s policies. Some insurance companies may require medical underwriting, which could affect your ability to switch plans or impact the premiums you pay.

Will Medicare Supplement Plan G in Texas cover prescription drugs?

No, Medicare Supplement Plan G in Texas does not cover prescription drugs. To obtain coverage for medications, you will need to enroll in a standalone Medicare Part D prescription drug plan, which is offered by private insurance companies.

Can I see any doctor or specialist with Medicare Supplement Plan G in Texas?

Yes, Medicare Supplement Plan G in Texas allows you to visit any healthcare provider who accepts Medicare patients. It does not have a network of preferred providers, giving you the freedom to choose any doctor or specialist who accepts Medicare assignment.

Is it necessary to enroll in Medicare Supplement Plan G in Texas?

Enrolling in Medicare Supplement Plan G in Texas is not mandatory. However, it can be beneficial for individuals who want comprehensive coverage while managing their healthcare costs. Plan G helps minimize out-of-pocket expenses, providing financial peace of mind.

Are there any future changes expected for Medicare Supplement Plan G in Texas?

Future changes to Medicare Supplement plans, including Plan G in Texas, can occur based on legislation or regulatory updates. It’s important to stay informed about any changes and evaluate available options when considering Medicare Supplement coverage in Texas.

Find the Right Medicare Plan for You

Searching for the right Medicare plan doesn’t have to be stressful. Whether it’s a Medigap plan, or you have questions about Medicare Advantage or Medicare Part D, we can help.

Call us today at 1-888-891-0229 and one of our knowledgeable, licensed insurance agents will be happy to assist you!