by Russell Noga | Updated August 31st, 2023

With the complexities of navigating healthcare costs, Medicare Plan G has emerged as a popular choice for comprehensive coverage at an affordable price. But how does it compare to other Medigap plans, and what factors should you consider when shopping for this supplemental insurance?

With the complexities of navigating healthcare costs, Medicare Plan G has emerged as a popular choice for comprehensive coverage at an affordable price. But how does it compare to other Medigap plans, and what factors should you consider when shopping for this supplemental insurance?

In this article, we’ll provide a detailed overview of Medicare Plan G, its benefits, costs, and how it stacks up against competitors. Join us as we unlock the secrets to making an informed decision about your healthcare coverage by exploring Medicare Plan G reviews.

Short Summary

- Medicare Plan G offers comprehensive coverage for most Part A and B expenses, excluding the annual Part B deductible.

- It is essential to compare Medicare Plan G with other Medigap plans in order to make an informed decision about healthcare coverage.

- Shopping for Medicare Plan G requires research, comparison of providers, and consulting a certified independent Medicare specialist.

Understanding Medicare Plan G: Coverage and Benefits

As one of the most comprehensive Medicare supplement plans, Medicare Supplement Plan G offers coverage for out-of-pocket expenses not covered under Medicare Part A and Part B for Medicare beneficiaries.

It has become a popular choice among new Medicare members due to its extensive coverage of various costs, providing assurance and financial relief for medical bills.

To make an informed decision, it’s essential to compare Medicare supplement plans for 2024 options like Plan G with other available Medicare supplement plans, including the Medicare supplement insurance plan offered by various Medicare supplement insurance companies.

Plan G covers many services, including hospitalization, doctor visits, and lab tests.

Coverage Details

Medicare Plan G provides coverage for most expenses associated with Medicare Part A and B, ensuring that you’re well-covered for various healthcare costs. However, it’s important to note that the annual Part B deductible is not included in Plan G’s coverage.

Despite this, it remains a popular choice among new Medicare beneficiaries due to its comprehensive coverage and attractive pricing.

It’s crucial to understand the extent of your coverage with Plan G and how it can benefit you. With coverage for everything except the Part B deductible, you can enjoy peace of mind knowing that your healthcare costs are taken care of, allowing you to focus on what truly matters: your health and well-being.

Standard vs. High Deductible Plan G

When considering Medicare Plan G, you’ll come across two options: Standard Plan G and High Deductible Plan G. Both options provide the same benefits but with a few key differences in monthly premiums and deductibles.

High Deductible Plan G is an attractive choice for those who prefer lower monthly premiums and can accommodate a higher annual deductible. This plan offers the same coverage as its Standard counterpart but with premiums ranging from $39 to $61 for a 65-year-old non-smoker in Atlanta.

The deductible for High Deductible Plan G is currently set at $2,700, adjusted annually according to inflation.

Weighing the pros and cons of both options is essential to determine which plan best suits your financial situation and healthcare needs.

Discover 2025 Plans & Rates

Enter Zip Code

Comparing Medicare Plan G with Other Medigap Plans

To make an informed decision about your healthcare coverage, it’s important to compare Medicare Plan G with other popular Medigap plans, such as Plan F and Plan N.

Understanding the differences in coverage and costs can help you choose the plan that best meets your needs and budget.

Comparing the plans can be a daunting task, but it’s important to understand the plans.

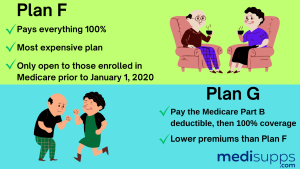

Plan G vs. Plan F

Though Plan G and Plan F offer identical fundamental benefits, there is a key difference: Plan F covers the Part B deductible, while Plan G does not. If the additional cost of Plan F exceeds the Part B deductible of $226 in 2023, then Plan G becomes the more cost-effective option.

Additionally, Plan F is no longer available to new beneficiaries due to Plan G’s increased cost-effectiveness and comprehensive coverage.

The choice between Plan G and Plan F ultimately depends on your personal preferences and budget. For those who prioritize comprehensive coverage without the Part B deductible, Plan G may be the better choice.

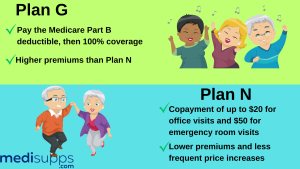

Medicare Plan G vs. Plan N

Comparing Plan G and Plan N reveals that both plans share the same fundamental benefits. Plan N includes a copayment of up to $20 for certain office visits and up to $50 for emergency room visits.

Those visits must not lead to inpatient admission for the copayment to be applied. Plan G, on the other hand, offers more comprehensive coverage, including the Part B deductible and excess charges.

The cost discrepancy between Plan G and Plan N is also worth noting. Plan G generally has higher premiums and more frequent price increases compared to Plan N. Depending on your healthcare needs and budget, one plan may be more appealing than the other.

Medicare Plan G Costs and Premiums

The cost of Medicare Plan G can vary depending on several factors, including age, location, and tobacco use. Understanding these factors can help you better estimate your monthly premiums and make an informed decision about your healthcare coverage.

It is important to research the different plans available and compare the costs and benefits of each.

Monthly Premium Ranges

The monthly premiums for Medicare Plan G can differ based on age, location, and other factors. Here is an estimate of the average premiums for a 65-year-old non-smoker in Atlanta and other major cities throughout the US.

- Atlanta: $101 to $343

- New York City: $120 to $400

- Los Angeles: $110 to $370

- Chicago: $105 to $355

- Houston: $100 to $340

Please note that these are just estimates, and actual premiums may vary.

In general, the average monthly premium for Medicare Plan G is around $145 for a 65-year-old, but prices can range from $30 to $413 per month depending on individual circumstances. It’s essential to carefully consider these factors when budgeting for your healthcare coverage.

Factors Affecting Premiums

Several factors can impact the cost of Medicare Plan G premiums. These factors include:

- Age: Premiums tend to increase with age.

- Location: Premiums can vary based on where you live.

- Tobacco use: Tobacco users may face higher premiums for their Medicare Plan G coverage.

- Gender: Premiums may be higher depending on your gender.

By understanding these factors and how they affect your monthly premiums, you can better prepare for the financial aspects of your healthcare coverage.

Enrollment and Medical Underwriting for Medicare Plan G

Enrolling in Medicare Plan G and navigating the medical underwriting process can be complex.

Knowing when to enroll and understanding any medical underwriting exceptions is crucial to ensure you receive the coverage you need.

It is important to research the different plans available and understand the medical underwriting process. This will be done.

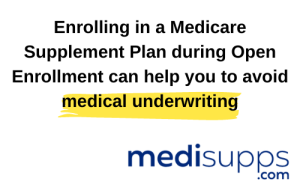

Medigap Open Enrollment Period

The Medigap Open Enrollment Period is a critical time for individuals seeking Medicare Plan G coverage. This six-month period begins the month an individual turns 65 and enrolls in Medicare Part B.

Insurance companies cannot factor in your health or medical history when setting Plan G premiums, making it the most cost-effective and hassle-free way to get insurance. This ensures everyone has equal access to coverage during this difficult time.

If you enroll in a Medigap plan outside of the Open Enrollment Period, you may be required to answer health-related questions.

There is no guarantee that you will be accepted. It’s important to be aware of this enrollment period and plan accordingly to secure the best possible coverage for your needs.

Medical Underwriting Exceptions

While medical underwriting is typically required for Medigap plans, certain exceptions may be available for individuals with disabilities or end-stage renal disease.

Navigating these exceptions can be challenging, but brokers are available to provide assistance and information on state-specific rules.

By seeking support from experienced brokers, you can better understand the medical underwriting process and any exceptions that may apply to your situation.

With their guidance, you can find the Medicare Plan G coverage that best suits your healthcare needs and financial circumstances.

Evaluating Medicare Plan G Providers

Selecting a Medicare Plan G provider involves more than just comparing prices.

Evaluating providers based on their financial ratings and customer service can help ensure you choose a reliable and reputable company to handle your healthcare coverage.

It is important to research the provider’s financial ratings and customer service reviews to make sure they are trustworthy.

Financial Ratings

Financial Ratings

Financial ratings are a crucial factor to consider when selecting a Medicare Plan G provider. These ratings measure an insurance carrier’s financial stability and strength, reflecting their ability to honor claims and meet financial obligations.

Providers such as Mutual of Omaha and Blue Cross Blue Shield are known for their strong financial ratings.

To assess a provider’s financial strength, you can review ratings from independent agencies such as A.M. Best, Standard & Poor’s, and Moody’s. By carefully considering these ratings, you can make a well-informed decision when choosing a Medicare Plan G provider.

Customer Service

Customer Service

Excellent customer service is essential when enrolling in Medicare Plan G. An agent or provider that offers superior customer service can help you find the most suitable coverage and rate through a leading carrier.

When assessing Medicare Plan G providers, be sure to research and compare different companies based on industry ratings, customer reviews, and pricing.

By prioritizing quality customer service, you can ensure a smooth enrollment process and feel confident in your healthcare coverage choice.

Pros and Cons of Medicare Plan G

Medicare Plan G offers several advantages, including comprehensive Medicare coverage and affordability. However, it does not cover the Part B deductible, which can be a disadvantage for some individuals.

In this context, it’s essential to compare it with other options, such as Medicare Advantage plans, to make an informed decision.

Despite this drawback, Medigap Plan G remains a popular choice for those seeking extensive coverage at a more economical cost than other Medigap plans.

By carefully weighing the pros and cons, you can determine if Medicare Plan G is the right choice for your healthcare needs.

Compare Medicare Plans & Rates in Your Area

Tips for Shopping for Medicare Plan G

When shopping for Medicare Plan G, it’s important to compare providers, seek assistance from licensed agents, and consider historical trends. Thorough research can help you make an informed decision about your coverage and ensure you receive the best value for your healthcare needs.

Consulting a certified independent Medicare specialist can help you identify the carrier with the most cost-effective year-over-year price increases. These professionals can provide a comprehensive understanding of the benefits that best meet your needs and help you navigate the enrollment process with ease.

By taking the time to shop around, compare providers, and seek expert advice, you can find the Medicare Plan G coverage that best suits your individual requirements and budget.

Medicare Plan G Popularity and Growth

In recent years, Medicare Plan G has experienced significant growth in popularity and enrollment rates. This surge can be attributed to its comprehensive coverage and affordability, making it an appealing choice for many individuals seeking supplemental insurance.

Plan G’s enrollment increased by 22% from 2019 to 2020, the highest growth among any Medigap plan. Meanwhile, Plan F enrollment decreased by 8%.

Plan G enrollment more than doubled from 2017 to 2020, further showcasing its growing popularity among Medicare beneficiaries. With its extensive coverage and competitive pricing, it’s no wonder that Plan G has become a top choice for supplemental insurance.

Summary

In conclusion, Medicare Plan G offers comprehensive coverage and affordability for individuals seeking supplemental insurance.

With its growing popularity and enrollment rates, it’s essential to carefully evaluate providers, costs, and coverage options when making a decision about your healthcare needs.

By following the tips and advice provided in this article, you can make an informed choice about Medicare Plan G and secure the coverage that best suits your individual requirements and budget.

Compare 2025 Plans & Rates

Enter Zip Code

Frequently Asked Questions

What are Medicare Plan G reviews and why are they important?

Medicare Plan G reviews are assessments and feedback provided by individuals who have experienced or are currently enrolled in Medicare Plan G. They are important as they offer valuable insights into the benefits, coverage, and overall satisfaction of the plan.

How can I find authentic Medicare Plan G reviews?

To find genuine Medicare Plan G reviews, you can visit official Medicare websites, online forums, social media groups, and review platforms dedicated to healthcare plans.

What aspects of Medicare Plan G are commonly mentioned in reviews?

Medicare Plan G reviews often discuss coverage for medical expenses, foreign travel benefits, premium costs, claims processing, customer service quality, and ease of access to healthcare providers.

How do positive Medicare Plan G reviews typically describe the plan?

Positive reviews of Medicare Plan G often highlight its comprehensive coverage, minimal out-of-pocket costs, flexibility in choosing healthcare providers, and the peace of mind it offers during medical emergencies.

What are some common concerns raised in negative Medicare Plan G reviews?

Negative reviews might express concerns about premium costs, confusion over coverage details, limitations in specific medical services, and challenges faced during claims processing.

How can reading Medicare Plan G reviews help me make an informed decision?

Reading Medicare Plan G reviews can provide you with insights from real beneficiaries, helping you understand both the advantages and potential drawbacks of the plan, enabling you to make a more informed enrollment decision.

Are there any trends or patterns that can be observed in Medicare Plan G reviews?

Yes, trends in reviews can reveal common experiences shared by beneficiaries, such as appreciation for the standardized coverage across different insurance providers or concerns about changes in premium rates.

Can Medicare Plan G reviews help me anticipate potential challenges?

Absolutely, reviews can give you an idea of challenges that others have faced, helping you anticipate potential issues and prepare for them, or seek clarification before enrolling.

How should I weigh the information from Medicare Plan G reviews?

It’s important to consider both the overall trends in reviews and individual experiences. Look for consensus in the feedback and focus on aspects that align with your personal healthcare needs and priorities.

Can I leave my own Medicare Plan G review?

Yes, many platforms allow beneficiaries to leave their own reviews. Sharing your experience can contribute to the collective knowledge and help others make informed decisions.

Find the Right Medicare Plan for You

Finding the perfect Medicare plan doesn’t have to be confusing. Whether it’s a Medigap plan, or you have questions about Medicare Advantage or Medicare Part D, we can help.

Contact us today at 1-888-891-0229 and one of our knowledgeable, licensed insurance agents will be happy to assist you!