by Russell Noga | Updated January 3rd, 2024

Medicare Plan N in Georgia

Navigating the world of Medicare can be overwhelming, especially when it comes to finding the right Medicare Supplement plan.

Navigating the world of Medicare can be overwhelming, especially when it comes to finding the right Medicare Supplement plan.

If you’re a Georgia resident looking for comprehensive coverage at a lower cost, Medicare Plan N in Georgia might be the perfect fit for you.

In this blog post, we will explore the ins and outs of Plan N, its benefits, and how it compares to other Medigap plans in Georgia.

Get ready to dive into the world of Medicare Plan N in Georgia and discover if it’s the right choice for your healthcare needs.

Short Summary

- Medicare Plan N in Georgia is a popular Medigap plan with lower premiums, but limited coverage.

- Eligibility requirements and factors affecting premiums should be considered when choosing the right provider for one’s needs.

- Prescription drug coverage must be obtained separately, while additional resources are available to help make an informed decision about Medicare plans in Georgia.

Understanding Medicare Plan N in Georgia

Medicare Plan N is a popular Medigap plan that offers comprehensive Medicare supplement insurance coverage at a relatively lower cost compared to other plans in Georgia.

By enrolling in a Medicare Supplement plan, Georgia residents can enjoy minimal to no out-of-pocket costs when receiving care from an approved physician.

However, it’s important to note that the expense of Georgia Medicare supplement plans is contingent upon various factors such as:

- the type of plan

- the time of enrollment

- the geographic location

- and more.

While this blog post focuses on Medigap plans like Plan N, it’s crucial to remember that a Medicare Advantage plan is another available option for Georgia residents seeking additional coverage.

Medicare Advantage plans offer alternative coverage options and may include additional benefits such as dental, vision, and prescription drug coverage.

Coverage Offered by Plan N

Plan N is a Medicare Supplement plan that assists in offsetting the out-of-pocket costs incurred through Original Medicare.

Plan N is a Medicare Supplement plan that assists in offsetting the out-of-pocket costs incurred through Original Medicare.

This Medigap plan encompasses the full Medicare Part A deductible and coinsurance, as well as the Medicare Part B coinsurance.

It is important to note that Plan N is different from Medicare Advantage plans, which offer alternative coverage options and may include additional benefits.

However, Plan N does not cover all out-of-pocket costs. Specifically, it does not provide coverage for the Part B deductible and certain copayments.

To prevent incurring additional charges, beneficiaries must be mindful of these coverage gaps and plan accordingly.

Plan N Copayments and Deductibles

Plan N is a popular Georgia Medicare supplement plan that offers comprehensive coverage at a relatively lower cost compared to other plans.

This Medigap plan helps cover costs not covered by Original Medicare, such as deductibles, coinsurance, and copayments.

It’s important for beneficiaries to be aware of the copayments and deductibles associated with Medicare Plan N in Georgia. For example, Plan N does not cover the Part B deductible and certain copayments.

Understanding these specific costs will allow beneficiaries to make informed decisions about their healthcare expenses and avoid unexpected out-of-pocket expenses.

View Rates for 2024 Now

Enter Zip Code

Comparing Plan N to Other Medigap Plans in Georgia

When selecting a Medicare Supplement plan, it’s essential to compare different plans to ensure you choose the one that best suits your needs.

In this section, we will highlight the differences between Plan N and other popular Medigap plans like Medicare Supplement Plan F and Plan G.

Plan F, for example, offers the most comprehensive coverage, including the annual Part B deductible, which is not covered by Plan N.

Knowing the distinctions between various Medigap plans will help you make an informed decision and choose the best plan for your healthcare needs.

Key Differences Between Plan N and Other Medigap Plans

One of the main differences between Plan N and other Medigap plans is the coverage gaps. Specifically, Plan N does not cover the Part B deductible and certain copayments.

One of the main differences between Plan N and other Medigap plans is the coverage gaps. Specifically, Plan N does not cover the Part B deductible and certain copayments.

Comparatively, Plan G provides comprehensive coverage, apart from the Part B deductible, whereas Plan F covers the annual Part B deductible.

When considering the costs of these plans, it is important to note that Plan N generally offers reduced premiums compared to other plans like Plan F and Plan G.

This makes Plan N an attractive option for those who are seeking comprehensive coverage at a more affordable price.

Pros and Cons of Choosing Plan N

Like all Medigap plans, Plan N comes with its own set of advantages and disadvantages.

One of the most notable benefits of Medicare Plan N in Georgia is its nearly comprehensive coverage, lower premiums, and coverage for Part A coinsurance and extra days of hospitalization.

However, there are some drawbacks to choosing Plan N. Beneficiaries will be responsible for paying the Part B deductible and excess charges, and it is not as comprehensive as some other Medigap plans.

It’s essential to weigh these pros and cons before deciding if Plan N is the right choice for you.

Costs of Medicare Plan N in Georgia

Understanding the costs associated with Medicare Plan N in Georgia is crucial for potential enrollees. The cost of Medicare Supplement Plans in Georgia is subject to factors such as:

- Location

- Age

- The chosen company and plan

- Other considerations

The cost of a Medicare Supplement plan in Georgia can vary significantly. On average, these plans range from $125 to $185.

It is important to note that the costs of Medicare Supplement plans in Georgia may increase annually.

To obtain the precise monthly premium for all carriers of Medicare Supplement Plan in Georgia, it is recommended to use the FREE Medicare Supplement Plan Rate Quote Service.

Factors Affecting Plan N Premiums

The premiums for Plan N in Georgia are determined by factors such as age, geographical area, and insurer.

For example, issue-age rating indicates that the premium cost does not increase in accordance with one’s age, whereas community rating implies that gender does not influence the calculation of the premium.

Taking these factors into account will help you better understand the costs associated with Medicare Plan N in Georgia and make an informed decision when choosing a Medigap plan.

Average Premiums for Plan N in Georgia

The typical range of premiums for Medicare Plan N in Georgia is between $100 and $150, depending on various considerations. The average cost of Medicare Plan N in Georgia is approximately $96 per month.

The typical range of premiums for Medicare Plan N in Georgia is between $100 and $150, depending on various considerations. The average cost of Medicare Plan N in Georgia is approximately $96 per month.

It’s crucial to remember that factors like age, location, and insurance company may affect these average premiums.

Keeping this in mind will help you find the most affordable and comprehensive medical insurance coverage for your healthcare needs.

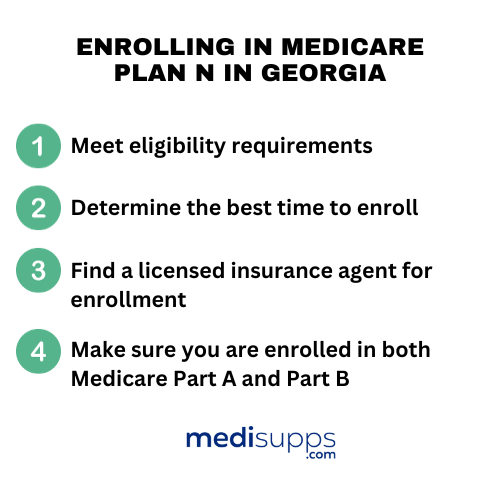

Enrollment Process for Medicare Plan N in Georgia

Enrolling in Medicare Plan N in Georgia involves the following steps:

- Meet eligibility requirements.

- Determine the best time to enroll.

- Find a licensed insurance agent for enrollment.

- Make sure you are enrolled in both Medicare Part A and Part B.

The best time to enroll in Plan N is during the Medigap Open Enrollment Period, which is a six-month period commencing upon the initial enrollment of Medicare Part B at age 65.

During this period, insurance companies cannot use medical underwriting to determine whether to accept your application or alter the price.

Eligibility Requirements for Plan N

The eligibility requirements for Plan N in Georgia are identical to those for other Medigap plans, necessitating enrollment in Medicare Part A and B.

The age for eligibility for Medicare is 65. Exceptions can be made if you have SSDI benefits.

To be eligible for SSDI benefits, you must have worked and paid Social Security taxes for a certain period of time. Understanding these eligibility requirements will help you determine if you qualify for Medicare Plan N in Georgia.

Best Time to Enroll in Plan N

The best time to enroll in Plan N is during the Medigap Open Enrollment Period, which starts on the first day of the month you turn 65 and lasts for six months.

During this period, an insurance company is prohibited from utilizing medical underwriting to determine whether to accept an application or alter the price.

During this period, an insurance company is prohibited from utilizing medical underwriting to determine whether to accept an application or alter the price.

Enrolling in Plan N during the Medigap Open Enrollment Period ensures that you can obtain the best rate for Plan N without the risk of being declined coverage or paying an excessive amount.

Top Medicare Plan N Providers in Georgia

Choosing the right Medicare Plan N provider is an important step in ensuring that you receive the best coverage at the most affordable price.

Some of the most prominent providers of Medicare Plan N in Georgia include Aetna, Mutual of Omaha, and UnitedHealthcare.

When selecting a Plan N provider, it is important to consider factors such as cost, coverage, and reputation. By comparing different providers, you can make an informed decision and choose the best Medicare supplement provider for your needs.

How to Choose the Right Plan N Provider

In order to choose the right Plan N provider, it is advisable to assess the costs, coverage, and customer reviews of various insurance carriers. Some of the top-rated Medicare Plan N providers in Georgia include Aetna, Blue Cross Blue Shield, and Cigna.

In order to choose the right Plan N provider, it is advisable to assess the costs, coverage, and customer reviews of various insurance carriers. Some of the top-rated Medicare Plan N providers in Georgia include Aetna, Blue Cross Blue Shield, and Cigna.

By comparing different providers and considering factors such as cost, coverage, and reputation, you can ensure that you choose the best Plan N provider in Georgia to meet your healthcare needs.

Prescription Drug Coverage with Plan N in Georgia

It’s essential to understand that prescription drug coverage is not included in Medicare Supplement plans in Georgia, including Plan N. To obtain medication coverage, beneficiaries must add a separate Medicare Part D plan.

Prescription drug plans are available in Georgia at a very affordable rate. It can be as low as $20 per month.

Knowing the separate costs and coverage for prescription drug plans is vital for Georgia Medicare beneficiaries to ensure comprehensive healthcare coverage, including medications.

Additional Resources for Georgia Medicare Beneficiaries

Navigating the world of Medicare can be challenging, but there are local resources and organizations available to help Georgia seniors explore their options and choose the best Medigap plan for their needs.

Organizations in Georgia, such as Area Agencies on Aging (AAAs), local public health agencies, and nonprofit groups, provide guidance and services for seniors.

Organizations in Georgia, such as Area Agencies on Aging (AAAs), local public health agencies, and nonprofit groups, provide guidance and services for seniors.

Supplementary Medicare benefits resources available for Georgia Medicare beneficiaries include:

- QMB program

- Medicare Savings Programs

- GeorgiaCares

- Georgia SHIP

These resources can provide valuable assistance in understanding and selecting the best Medicare Supplement plan for your healthcare needs, including medicare supplement insurance plans.

Summary

In conclusion, Medicare Plan N in Georgia offers comprehensive coverage at a lower cost compared to other Medigap plans.

It’s important to understand the coverage gaps, costs, and eligibility requirements associated with Plan N and compare it to other available plans.

By utilizing available resources, Georgia Medicare beneficiaries can make informed decisions about their healthcare coverage and choose the best Medigap plan to meet their needs.

Get Quotes in 2 Steps!

Enter Zip Code

Frequently Asked Questions

What is the Medicare Plan N?

Medicare Plan. N helps pay for out-of-pocket expenses not covered by Medicare Parts A and B, such as the Part A deductible of $1,600, coinsurance for Parts A and B, three pints of blood and 80% of medical costs incurred during foreign travel.

It has lower premiums than other Medigap Plans, but does not cover the Medicare Part B deductible.

What are the disadvantages of Plan N?

Plan N has the disadvantage of not covering certain services, such as Part B excess charges and foreign travel emergency care. It also comes with a higher copayment for hospital stays and no coverage of hospice care.

These features make Plan N an unfavorable option for many seniors.

How is Plan N different from Plan G?

Plan G offers more comprehensive coverage than Plan N, including coverage of excess charges which are not covered by Plan N. Additionally, Plan N requires copays for some medical office and emergency department visits that Plan G does not.

As a result, Plan N may be more affordable overall if the copays are infrequent.

Does Plan N include prescription coverage?

Medicare Plan. N does not cover prescription drugs, dental care, vision care, or hearing aids. To get coverage for those services and prescription drugs, you will need to purchase a separate Medicare Part D plan.

What is the best time to enroll in Plan N?

Enrolling in Plan N during the Medigap Open Enrollment Period, which starts on your 65th birthday and lasts for six months, is recommended for the best rate.

This is the best time to enroll in a Medigap plan, as you are guaranteed to be accepted and you will get the best rate.

Find the Right Medicare Plan for You

Finding the right Medicare Plan 2024 doesn’t have to be confusing. Whether it’s a Medigap plan, or you want to know more about Medicare Plan N in Georgia, we can help.

Call us today at 1-888-891-0229 and one of our knowledgeable, licensed insurance agents will be happy to assist you!

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.