by Russell Noga | Updated January 9th, 2024

Do you have Original Medicare Parts A & B? These policies help seniors cope with managing their healthcare expenses as they age. While Medicare is extremely beneficial, it doesn’t cover all hospital and Medicare costs completely. You could find yourself dealing with mounting out-of-pocket expenses related to your healthcare.

Do you have Original Medicare Parts A & B? These policies help seniors cope with managing their healthcare expenses as they age. While Medicare is extremely beneficial, it doesn’t cover all hospital and Medicare costs completely. You could find yourself dealing with mounting out-of-pocket expenses related to your healthcare.

A Medicare supplement plan, “Medigap,” partially or fully covers the remaining financial responsibility for these expenses. Medigap plans are available from private healthcare providers like Highmark. The best time to enroll in Highmark Medigap Blue is during “Open Enrollment” for six months after your 65th birthday.

Highmark must accept your application to its Medigap Blue program during this time, even if you have pre-existing health conditions. This post unpacks the offering from Highmark Medigap Blue. We’ll examine the plans, benefits, premiums, and perks.

Compare 2025 Plans & Rates

Enter Zip Code

Highmark Medigap Blue Medicare Supplement Plans at a Glance

- Highmark offers a good range of Medigap plans.

- The company services West Virginia, Delaware, and most areas in Pennsylvania.

- Moderately priced premiums across their plan range.

- The “Whole Health Balance” is offered for an additional fee, covering dental and hearing benefits and gym memberships.

Who Is Highmark Medigap Blue?

Highmark is a member of the Blue Cross Blue Shield Association. Highmark Blue Shield was formed in 1996 after consolidating the Blue Cross of Western Pennsylvania and Pennsylvania Blue Shield. In 1999, Highmark partnered with Mountain State Blue Cross Blue Shield to become the primary licensee of BCBS in West Virginia. Highmark offers Medicare supplement plans in West Virginia, Delaware, and most areas in Pennsylvania.

What Medicare Supplement Plans Does Highmark Medigap Blue Offer?

Highmark has a good selection of Medigap plans. Let’s take a brief look at the coverage offered by each policy.

Plan A – Basic benefits.

Plan B – Basic benefits plus coverage for the Medicare Part A deductible.

Plan C – Near-comprehensive coverage of Medicare Part A & B benefits. No coverage for Medicare Part B excess charges.

Plan D – Good coverage, but no benefit for the Medicare Part B deductible or excess charges.

Plan F – Comprehensive cover of all Medicare Part A & B benefits.

Plan F (HD) – The same benefits as the standard plan. The Medicare Part A deductible increases from $1,600 to $2,700, but you get a huge reduction in premiums.

Plan G – Near comprehensive coverage, but no Medicare Part B deductible coverage.

Plan N – Comes with copays for visiting the doctor and emergency room. No coverage for the Medicare Part B deductible or excess charges.

Compare Medicare Plans & Rates in Your Area

Highmark Medigap Blue Medicare Supplement Plans – Benefits & Coverage

Medicare is a federally-funded program, but private healthcare insurers offer Medigap plans. The CMS, a federal agency, regulates the market, ensuring all providers offer standardized benefits in Medigap plans. So, Highmark Medigap Blue offers the same plan benefits as any other provider.

All Medigap plans offer the following benefits for Original Medicare Parts A & B.

- Part A coinsurance and hospital costs for up to 365 days after using up Medicare benefits.

- Part A hospice care coinsurance or copayment.

- Part B coinsurance or copayment.

- Blood transfusion costs for the first three pints of blood.

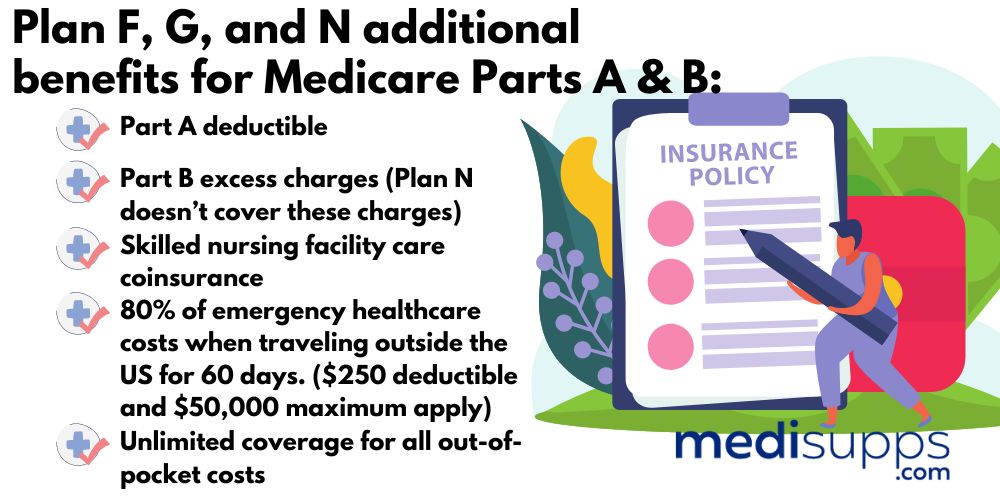

Plans F*, G, and N offer additional Medicare Parts A & B benefits.

- Part A deductible.

- Part B excess charges (Plan N doesn’t cover these charges).

- Skilled nursing facility care coinsurance.

- 80% of emergency healthcare costs when traveling outside the US for 60 days. ($250 deductible and $50,000 maximum apply).

- Unlimited coverage for all out-of-pocket costs.

*Plan F is no longer available to new Medicare beneficiaries due to its coverage of the Part B deductible. If you’re eligible for Medicare before January 1, 2020, you can still apply for Plan F with Highmark, but you might have to undergo a medical underwriting.

Underwriting accounts for your pre-existing conditions, and Highmark can use this information to charge you higher-than-average monthly premiums or deny your application to join its Medigap scheme. In some cases, you might qualify for “guaranteed issue rights.”

These protections prevent Highmark from using medical underwriting when you join. Contact our team to find out if you qualify for guaranteed issue rights.

What Highmark Medigap Blue Medicare Supplement Plans Don't Cover

Medigap plans work by providing coverage for the out-of-pocket costs associated with medical and hospital services covered by Original Medigap Plans A & B. If your medical treatments don’t fall under Medicare Parts A & B, Medigap plans won’t cover the costs of these services.

As a result, there’s no coverage for dental, vision, or hearing services or your prescriptions. You don’t have coverage for stays at unskilled nursing homes or private-duty nursing. There’s no coverage for cosmetic procedures or preventative services involving chiropractic, physiotherapy, acupuncture, or podiatry.

Sometimes, Medicare might cover these services if your doctor deems them medically necessary, and Medigap will cover the out-of-pocket expenses.

Highmark Medigap Blue Medicare Supplement Plans – Premiums

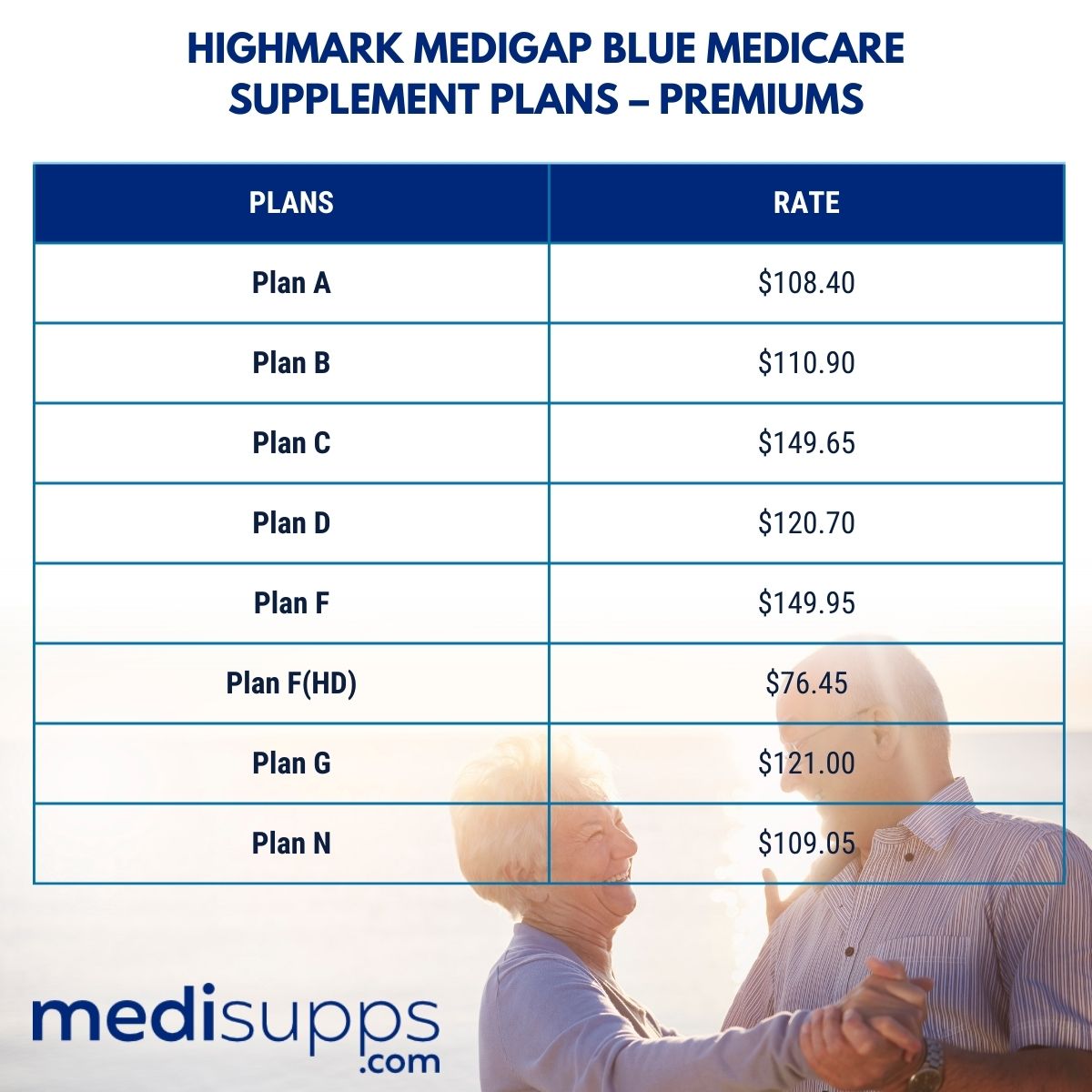

Highmark uses a risk assessment to set your premiums when you join their Medigap plan. They look at your age, gender, smoking status, and location in the United States to factor in the risk you present to their Medigap plan when calculating your premiums. According to our research, a 65-year-old female no-smoker will pay the following average monthly premiums with Highmark Blue Medigap plans.

- Plan A: $108.40

- Plan B: $110.90

- Plan C: $149.65

- Plan D: $120.70

- Plan F: $149.95

- Plan F (HD): $76.45

- Plan G: $121.00

- Plan N: $109.05

*Your premium rates may vary depending on your unique risk profile.

Highmark Medigap Blue Medicare Supplement Plans – Additional Benefits & Discounts

Highmark offers the optional “Whole Health Balance” program giving members benefits for dental, hearing, and fitness services for an additional $34.50 per month.

Highmark Medigap Blue Medicare Supplement Plans – Third-Party Ratings & Reviews

Highmark has an A rating with AM Best for its financial strength and an A- rating with the Better Business Bureau.

Compare 2025 Plans & Rates

Enter Zip Code

Frequently Asked Questions

A Guide to Highmark Medigap Blue Medicare Supplement Plans

Highmark Medigap Blue offers a range of Medicare Supplement plans to help fill the gaps in Original Medicare. These plans provide additional coverage for out-of-pocket expenses, giving beneficiaries peace of mind and predictable healthcare costs. Let’s explore the essential details about Highmark Medigap Blue Medicare Supplement Plans:

Who is eligible for Highmark Medigap Blue Medicare Supplement Plans?

To be eligible for Highmark Medigap Blue plans, individuals must be enrolled in Medicare Part A and Part B. The best time to enroll is during the Medigap Open Enrollment Period, which starts when you are 65 or older and enrolled in Part B. During this period, you have guaranteed issue rights, ensuring you can access any Medigap plan without medical underwriting.

When can you enroll in Highmark Medigap Blue Medicare Supplement Plans?

The Medigap Open Enrollment Period is the ideal time to enroll in Highmark Medigap Blue plans. After this period, you can still apply, but insurance companies may consider your health status, and you may have limited options.

What are the best Medicare Supplement plans offered by Highmark Medigap Blue?

Highmark Medigap Blue offers various plans, but the best one depends on individual healthcare needs and budget. Plan G and Plan N are popular choices due to their comprehensive coverage and cost-effectiveness.

What does Highmark Medigap Blue Plan G cover?

Highmark Medigap Blue Plan G covers most of the gaps in Original Medicare, including Part A and Part B coinsurance, hospice care coinsurance, and the first three pints of blood. It also covers skilled nursing facility care coinsurance and 80% of foreign travel emergency costs.

What does Highmark Medigap Blue Plan N cover?

Highmark Medigap Blue Plan N provides similar coverage to Plan G, but beneficiaries must pay certain cost-sharing amounts, such as a copayment for doctor’s visits and emergency room visits. It does not cover the Part B deductible or Part B excess charges.

What is the difference between Highmark Medigap Blue plans and Medicare Advantage?

Highmark Medigap Blue plans work alongside Original Medicare, while Medicare Advantage plans replace Original Medicare. With Highmark Medigap Blue, you can see any healthcare provider that accepts Medicare. On the other hand, Medicare Advantage plans typically require beneficiaries to use a network of providers and follow plan rules.

How do Highmark Medigap Blue plans help with out-of-pocket expenses?

Highmark Medigap Blue plans help with out-of-pocket expenses by covering certain costs not paid by Original Medicare. Depending on the plan, beneficiaries can enjoy reduced or no copayments, coinsurance, and deductibles for Medicare-covered services.

Can you switch from a Medicare Advantage plan to Highmark Medigap Blue?

Yes, beneficiaries can switch from a Medicare Advantage plan to Highmark Medigap Blue during the Medicare Advantage Disenrollment Period, which runs from January 1st to February 14th each year. This allows individuals to return to Original Medicare and enroll in a Medigap plan.

Can you have both Highmark Medigap Blue and Medicaid?

Yes, individuals who are eligible for both Medicare and Medicaid, known as “dual-eligible” beneficiaries, can have both Highmark Medigap Blue and Medicaid coverage. Medicaid may help cover some Medicare costs, such as premiums and cost-sharing, depending on the state’s Medicaid program rules.

Call Us for More Information on Highmark Medigap Blue Medicare Supplement Plans

If you have questions on Highmark Medigap Blue, call us at 1-888-891-0229. Our team of fully licensed Medigap agents can assist you with choosing the right plan. We offer free consultations and quotes on any policy.

If you can’t call us now, leave your details on our contact form, and we’ll get a Medigap professional to reach out to you. Or you can use the tool on our site to get a free automated quote on any Medigap plan.