by Russell Noga | Updated October 2, 2024

Are you a former or current member of the military?

Are you a former or current member of the military?

USAA offers Medicare supplement insurance plans geared towards service members and their families. Medigap plans provide supplemental coverage for the out-of-pocket costs associated with Original Medicare Parts A & B.

USAA Medicare Supplement Plans at a Glance

- USAA is a financial services company serving former and current US military members.

- USAA has a niche range of Medigap plans, with Plans A, F, G, & N available.

- The company has good customer service ratings and excellent financial strength ratings.

- USSA offers no perks or discount rewards programs with its Medigap policies.

- Plan premiums are in the average range.

Compare 2025 Plans & Rates

Enter Zip Code

Who Is USAA?

Founded by Army officers in 1922, USAA originally insured vehicles. Today, the company offers insurance, investment, and banking services to over 13 million members. Members include former and current US military personnel, their spouses, and children.

USAA offers Medicare Supplement plans in 45 states and Washington, D.C. Membership is free, and the company also offers life insurance products to non-military personnel.

What Medicare Supplement Plans Does USAA Offer?

USAA offers a niche range of Medigap plans to its members. It focuses on the most popular options, Plans F, G, & N.

Medigap Plan A — Basic benefits and Medicare Part B coinsurance.

Medigap Plan G — The most comprehensive Medigap plan for newly eligible Medicare members.

Plan F* – Comprehensive coverage, including Medicare Part B deductible benefit.

Medigap Plan N — Requires copayments and doesn’t cover Medicare Part B excess charges.

*Plan F is no longer available to seniors eligible for Original Medicare after January 1, 2020. If you qualify for Medicare after this date, you can go with Plan G instead. Plan G has the same Medicare Part A & B benefits but no coverage for the Medicare Part B deductible.

Compare Medicare Plans & Rates in Your Area

USAA Medicare Supplement Plans – Benefits & Coverage

All Medigap providers must adhere to regulations and guidelines set by the CMS for the standardized benefits offered in Medigap plans. That means the benefits provided in all Medicare supplement plans from USAA are the same as those from other insurers.

The coverage between Medigap plans varies widely, and some are more comprehensive than others. All Medigap providers must offer Plan A, per CMS guidelines. USAA only offers Medigap plans A, F, G, & N because these policies are the most popular options for new Medicare beneficiaries.

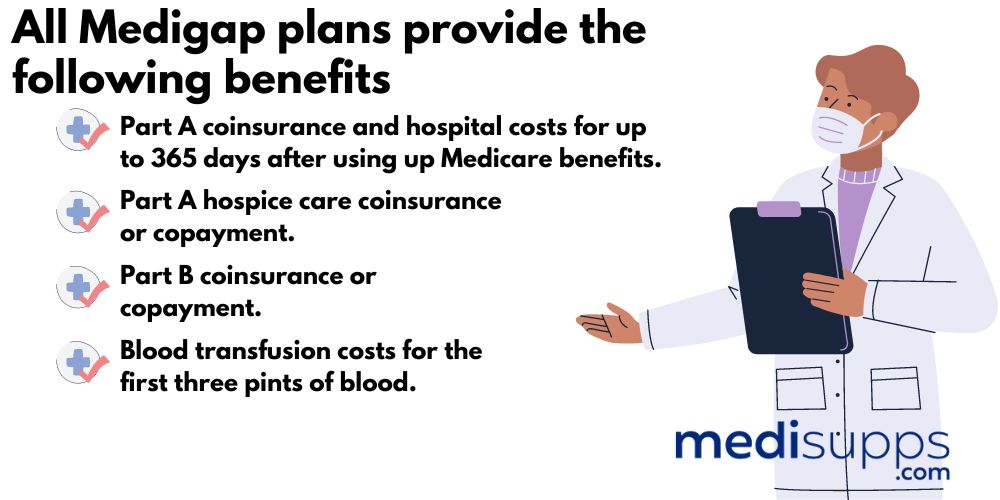

All Medigap plans offer the following benefits for Original Medicare Parts A & B.

- Part A coinsurance and hospital costs for up to 365 days after using up Medicare benefits.

- Part A hospice care coinsurance or copayment.

- Part B coinsurance or copayment.

- Blood transfusion costs for the first three pints of blood.

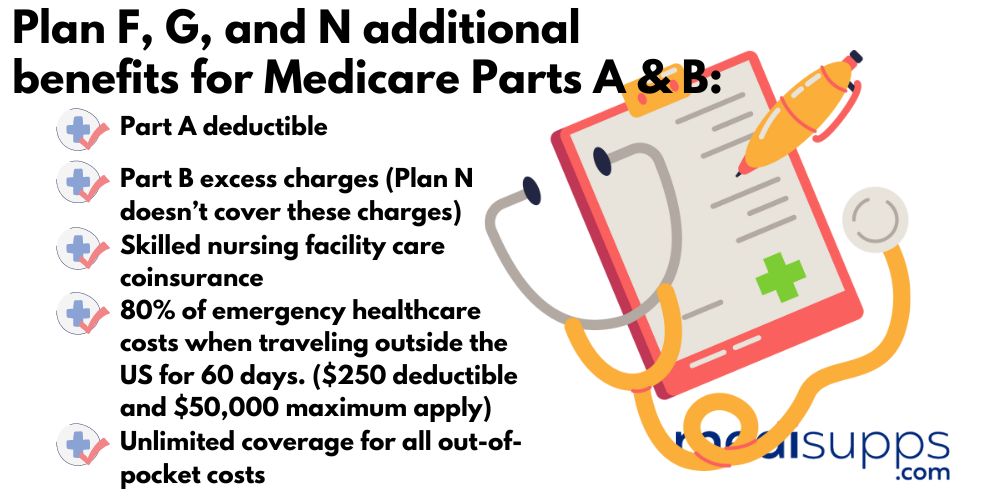

Plans F, G, and N* offer additional Medicare Parts A & B benefits.

- Part A deductible.

- Part B excess charges (Plan N doesn’t cover these charges).

- Skilled nursing facility care coinsurance.

- 80% of emergency healthcare costs when traveling outside the US for 60 days. ($250 deductible and $50,000 maximum apply).

- Unlimited coverage for all out-of-pocket costs.

*Plan N requires a $20 copayment at the doctor and a $50 copayment at the emergency room when not admitted into inpatient care at the hospital.

What USAA Medicare Supplement Plans Don't Cover

Medicare supplement plans only cover the expenses associated with Original Medicare Part A & B. If Original Medicare doesn’t cover certain healthcare expenses, Medigap policies won’t cover them either. You don’t have coverage for preventative treatments at the chiropractor, physiotherapist, or acupuncture therapist.

Sometimes, Medicare may approve preventative treatments if they relate to hospital care and if a doctor motivates them. For instance, if you have reconstructive jaw surgery due to injuries sustained in a car accident, Medicare will pay for follow-up dental treatments after your procedure if deemed medically necessary by your doctor.

Medigap won’t cover the costs of prescription, private-duty nursing, or stays at unskilled nursing homes. There’s no coverage for vision, hearing, or dental services.

Medigap Plan N doesn’t cover Medicare Part B excess charges. These are charges incurred when using doctors in the Medicare network that charge more than Medicare-approved rates. Doctors can charge up to 15% over the Medicare Assignment rate, and these fees are the “excess charges.”

USAA Medicare Supplement Plans – Premiums

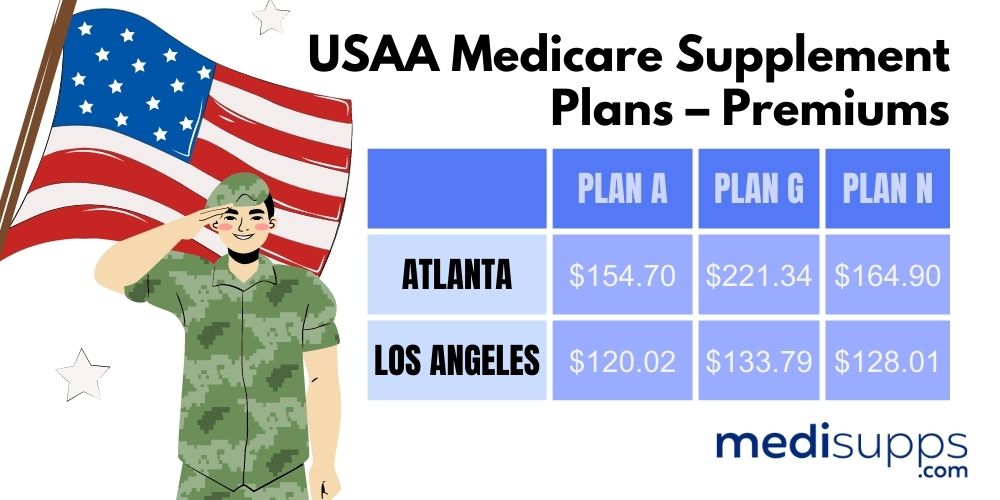

USAA creates a risk profile on you when setting your rates for Medigap premiums. The company uses your age, gender, smoking status, and location in the United States to set your monthly premiums. The rate can vary from state to state, women will pay less in premiums than men, and smokers will pay more than nonsmokers.

Here are the average rates for Plans A, G, & N for a 65-year-old female nonsmoker based in Atlanta or Los Angeles.

*Your rates may vary depending on your risk profile. Call our agents for an accurate quote on any Medigap plan from USAA.

USAA Medicare Supplement Plans – Additional Benefits

USAA has great rates on its Medigap plans. However, the company doesn’t offer any additional perks with its policies. Other companies offer perks like add-on plans for dental or vision or discounted rates on these services.

USAA is a great choice for people looking for supplemental coverage for Medicare Parts A & B, but don’t require any additional benefits or discount programs.

USAA Medicare Supplement Plans – Third-Party Ratings & Reviews

USAA has one of the best reputations for customer service in the Medigap market. Its complaint rate is less than half the market average. The company has an Aa1 rating from Moody’s and an A++ rating from AM Best for its financial strength.

Compare 2025 Plans & Rates

Enter Zip Code

Frequently Asked Questions

What Medicare Supplement plans does USAA offer?

USAA offers a range of Medicare Supplement plans, including Plan G, Plan N, and other standardized plans. These plans provide additional coverage to supplement Original Medicare.

Who is eligible to enroll in USAA Medicare Supplement plans?

Eligibility to enroll in USAA Medicare Supplement plans typically requires being enrolled in Medicare Part A and Part B. Enrollment is generally open to individuals who are 65 years or older, or those under 65 with certain disabilities.

What are the key features of USAA Medicare Supplement Plan G?

USAA Medicare Supplement Plan G offers comprehensive coverage, including coverage for Medicare Part A and B coinsurance, Part A deductible, Part B excess charges, and skilled nursing facility coinsurance.

What are the key features of USAA Medicare Supplement Plan N?

USAA Medicare Supplement Plan N provides coverage for Medicare Part A and B coinsurance, Part A deductible, and skilled nursing facility coinsurance. However, it does have cost-sharing in the form of copayments for certain services.

What is the difference between USAA Medicare Supplement Plan G and Plan N?

The main difference between USAA Medicare Supplement Plan G and Plan N is that Plan G offers more comprehensive coverage, including coverage for Part B excess charges, while Plan N has cost-sharing in the form of copayments for certain services.

What coverage and benefits do USAA Medicare Supplement plans offer?

USAA Medicare Supplement plans typically provide coverage for Medicare Part A and B coinsurance, hospital costs, and may include additional benefits such as coverage for skilled nursing facility care, foreign travel emergencies, and more. Coverage details may vary based on the specific plan.

Are there any additional benefits or perks offered by USAA Medicare Supplement plans?

While additional benefits and perks may vary, some USAA Medicare Supplement plans may offer benefits such as coverage for prescription drugs, vision and dental care, fitness programs, and telehealth services. It’s important to review the details of each plan to understand the specific benefits included.

How can I enroll in USAA Medicare Supplement plans?

To enroll in USAA Medicare Supplement plans, you can contact USAA directly or work with licensed insurance agents who represent USAA. These agents can assist you in the enrollment process and help you compare plan options.

What factors should I consider when comparing USAA Medicare Supplement plans?

When comparing USAA Medicare Supplement plans, important factors to consider include the specific coverage offered, premium rates, company reputation, customer service quality, financial stability, and any additional benefits or perks that align with your healthcare needs.

Where can I get more information about USAA Medicare Supplement plans?

To obtain more information about USAA Medicare Supplement plans, you can visit their official website or contact them directly. Additionally, licensed insurance agents who represent USAA can provide personalized guidance and assistance in understanding the plan options.

Call Us for More Information on USAA Medicare Supplement Plans

Call our team of fully licensed Medigap agents at 1-888-891-0229. We offer free consultations and quotes on any Medigap plan from any provider. We’ll ensure you get the right Medigap plan to cover your healthcare requirements and budget and the best rates on monthly premiums.

If you can’t call us right now, leave your details on our contact form. We’ll get a Medigap expert to call you back to discuss your healthcare needs. Or you can use the automated tool on our site for a free quote on any Medigap plan.

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.