by Russell Noga | Updated August 9th, 2023

Medicare, a federally-sponsored health insurance program, provides much-needed medical benefits for millions of Americans. The program, which is intended for people who are aged 65 and older, as well as those who have been diagnosed with qualifying disabilities or illnesses, covers a large portion of medical expenses; however, it doesn’t cover everything, and beneficiaries are responsible for the costs that it doesn’t cover.

Medicare, a federally-sponsored health insurance program, provides much-needed medical benefits for millions of Americans. The program, which is intended for people who are aged 65 and older, as well as those who have been diagnosed with qualifying disabilities or illnesses, covers a large portion of medical expenses; however, it doesn’t cover everything, and beneficiaries are responsible for the costs that it doesn’t cover.

For many, those out-of-pocket expenses can become costly and can result in financial hardship. Fortunately, Medicare Supplement Insurance can provide assistance for those expenses, making the cost of healthcare easier to predict and more affordable.

Medicare Supplement Insurance is provided by private health insurance companies, such as Mutual of Omaha, Allstate, Aetna, and many more.

Could CareFirst Medicare Supplement Insurance be the right choice for you? To make the most informed decision, in this guide, you’ll discover helpful information that can help you decide if it’s the right choice for your medical and financial needs.

Compare 2025 Plans & Rates

Enter Zip Code

How Does Medicare Supplement Insurance Work?

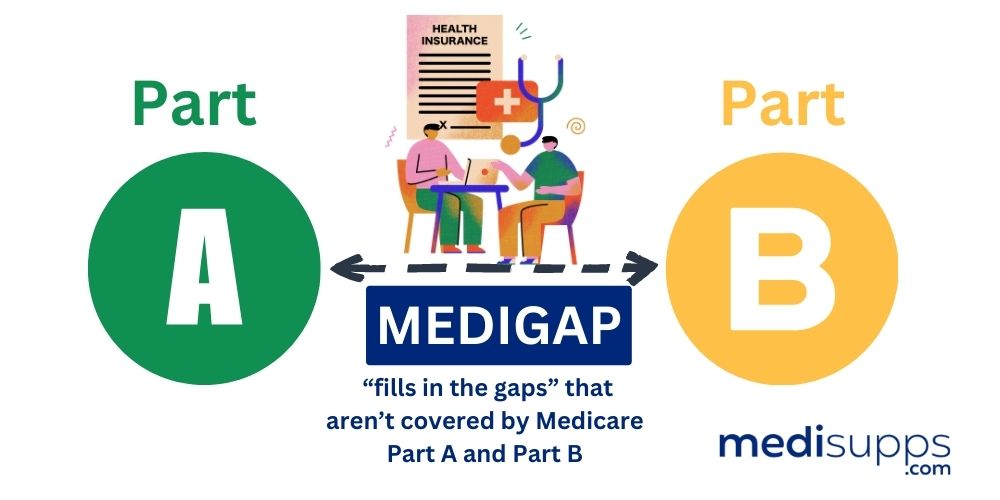

Medicare Supplement Insurance – Medigap – is supplementary insurance that is designed to work alongside Original Medicare. In other words, it doesn’t replace Original Medicare but rather it picks up the costs that the government-funded health insurance program doesn’t cover; deductibles, copays, and coinsurance, for example.

There are a total of 10 different Medicare Supplement Insurance plans. These plans, which are named for letters, provide different benefits, are sold by private health insurance companies, and are regulated by the federal government via the Centers for Medicare and Medicaid Services (CMS). All plans that are the same letter must provide the same standard benefits, as required by the government, regardless of the insurer or the location. The private health insurance companies that provide Medigap can, however, set their own rates, and can offer additional benefits, on top of the benefits that the plans they offer are required to provide.

In order to be eligible for Medicare Supplement Insurance, you must be enrolled in both parts of Original Medicare – Part A and Part B – and you cannot be enrolled in Medicare Advantage. Additionally, because Medidgap is separate insurance, it does have separate premiums that must be paid on a monthly basis.

About CareFirst

CareFirst is a non-profit organization that is affiliated with Blue Cross Blue Shield. The organization services Medicare beneficiaries who reside in Maryland, Northern Virginia, and Washington, DC. CareFirst was founded in 1935 and services about 75 percent of the individuals who receive medical benefits through Original Medicare in the state of Maryland. The company has a long-standing history of providing quality service and affordable rates for the Medicare Supplement Insurance plans that they offer. CareFirst has a solid financial rating, as is indicated by its B++ rating from AM Best.

What Kind of Medicare Supplement Insurance Plans Does CareFirst Offer?

CareFirst offers several Medigap policies for Medicare beneficiaries who reside in Maryland, Northern Virginia, and Washington, DC. The Medicare Supplement Insurance plans that CareFirst carries include the following:

- Medigap Plan A. This is the most basic Medigap policy, as it provides only the benefits that Medicare Supplement plans are required to offer and nothing more.

- Medigap Plan B. Plan B offers the same benefits as Plan A; however, it also covers 100 percent of the Part A deductible.

- Medigap Plan C. Plan C is considered one of the most comprehensive Medicare Supplement Insurance plans, as it covers most of the costs that aren’t covered by Original Medicare, including the Part B deductible.

- Medigap Plan F. This is the most inclusive Medigap plan, as it covers most of the Original Medicare’s out-of-pocket expenses, including the Part B deductible and Part B excess charges.

- Medigap Plan G. This plan offers all the same benefits that Plan F offers, except the Part B deductible. Individuals who have Plan G are responsible for the Part B deductible, which was $226 in 2023.

- Medigap Plan K. Plan K covers 50 percent of the Part A coinsurance and hospital expenses, as well as 50 percent of the Part B coinsurance or copayment.

- Medigap Plan L. This plan is similar to Plan K; however, it covers 75 percent of the Part A coinsurance and hospital expenses and 75 percent of the Part B coinsurance or copayment.

- Medigap Plan M. Medigap Plan M provides coverage for all of the expenses that Plan A covers, as well as 50 percent of the Part A deductible.

- Medigap Plan N. Plan N is considered a low-cost Medigap plan. It includes the same benefits as Plan D, excluding the Part B copays, which cost up to $20 per office visit and up to $50 per emergency room visit.

Compare Medicare Plans & Rates in Your Area

When to Enroll in CareFirst Medicare Supplement Insurance

If you reside in Maryland, Northern Virginia, or Washington, DC, you are enrolled in Medicare Part A and Part B, and you think that CareFirst Medicare Supplement Insurance is the right option for you, the ideal time to apply for coverage is during the Medicare Supplement Open Enrollment period. During this period, which starts on the first day of the month you turn 65 and lasts for a period of 6 months, insurance companies cannot consider your medical history or the current status of your health when assessing your application for Medigap insurance. As such, your application will more than likely be accepted and your rates will be lower.

Compare 2024 Plans & Rates

Enter Zip Code

If you wait to apply for CareFirst Medigap insurance until after the Medicare Supplement Open Enrollment period, the insurance company can consider your medical history and the current status of your health when reviewing your application. If you are in poor health – have a pre-existing condition, for example – it’s likely that your rates will be higher or worse, there is a chance that your application could be denied.

Frequently Asked Questions

What is Carefirst Medicare Supplement Insurance?

Call Us for More Information on National General Medicare Supplement Plans

Reach out to our team at 1-888-891-0229 for more information on National General Medicare supplement plans. We offer a free consultation and quote on any plan with the best premium rates in your state.

If you can’t call us right now, leave our contact details on our web form, and we’ll get a Medigap expert to call you. Or you can use the free tool on our site to get an automated quote on any Medigap plan.

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.